Use the following guide while gathering up your important tax documents for your 2024 personal tax returns. Please bring all required documents with you when having our tax preparation experts prepare and file your Federal and Missouri tax returns.

You are browsing archives for

Category: Personal Accounting & Tax

How Will Stimulus Payments Affect My Tax...

Due to the ongoing coronavirus pandemic, in 2020 the US government sent out two economic stimulus payments to eligible Americans. These stimulus payments have a lot of people asking how the stimulus payments will affect their 2020 tax returns and refunds. If you received either one or both of the economic stimulus payments in 2020 […]

Coronavirus Stimulus Checks

Due to the economic hardships faced by many Americans due to Covid-19, the government is providing most Americans with a stimulus payment to help ease the economic burdens many Americans are facing. Tax filers who already have their bank account information on file with the IRS will automatically receive a direct deposit. Filers who don’t […]

Tax Deadline Extended Until July 15, 202...

Due to the Coronavirus pandemic (COVID-19), the IRS has extended the deadline for filing your taxes until July 15, 2020. If you owe money this year to Uncle Sam, your payment also won’t be due until July 15, 2020. You will not receive any fees or penalties for late payment as long as you pay […]

Federal Tax Deadline Extended for Missou...

Victims of the 2016 flooding in Missouri will have extra time to file their 2015 federal income taxes. The IRS announced that flood victims will have until May 16th, 2016 to file their 2015 federal tax returns.

Does Missouri Offer Payment Plans for Ta...

Many people know that the IRS offers payment plans for tax balances owed by individuals and businesses for their federal taxes, but not everyone knows that Missouri offers payment plans for paying off taxes owed to the sate.

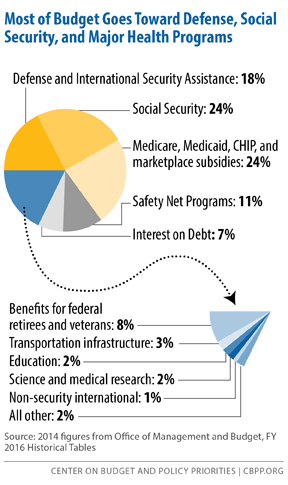

Where Do My Federal Tax Dollars Go?

Federal tax dollars are used to finance a lot of public services, including social security, the military, social welfare programs, education, and more. The following chart outlines how federal tax dollars are spent.

Tax Law Changes for Your 2014 Tax Return

There are several important changes to tax laws in the United States that will affect your 2014 tax return.

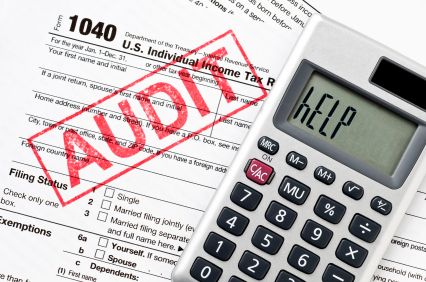

How to Reduce The Risk of An IRS Audit

Getting audited by the IRS can be an overwhelming and inconvenient experience. There are certain red flags the IRS looks for when deciding which taxpayers to audit. Below we list a few ways to reduce the risk of getting audited by the IRS.

What Happens If You Don’t Pay Your Taxes

Failing to pay your taxes can lead to serious consequences. The IRS is one of the most aggressive debt collectors out there, so it is important to pay your taxes as soon as possible, even if that means setting up a payment plan and paying your tax debt over time.