Small business accounting can be overwhelming for a small business owner. Practicing good bookkeeping and accounting can make or break your business. Below we go over 10 basics to small business accounting.

You are browsing archives for

Author: James Coats

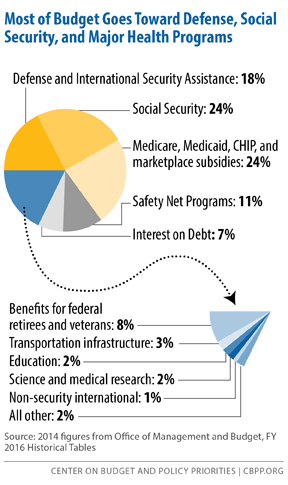

Where Do My Federal Tax Dollars Go?

Federal tax dollars are used to finance a lot of public services, including social security, the military, social welfare programs, education, and more. The following chart outlines how federal tax dollars are spent.

Tax Law Changes for Your 2014 Tax Return

There are several important changes to tax laws in the United States that will affect your 2014 tax return.

How To Deal With Small Business Debt

Utilizing credit via credit cards or loans can be beneficial for new or growing businesses, but sometimes businesses can take on too much debt which can cause the business to fail. When a business takes on too much debt there are two options; try to save the business while attempting to settle your outstanding debts, […]

How To Increase Your Business Credit Sco...

Improving your business credit score is similar to improving your personal credit score. Increasing your business credit rating allows you to get more credit via loans or credit cards, and also lowers your interest rates. Below we outline common ways to increase your business credit.

5 Tips to Avoid Payroll Issues and Penal...

Properly handling your business’s payroll is important for handling your taxes, properly paying employees, and avoiding penalties. Payroll and payroll tax laws are constantly changing, so it may be helpful for your business to have a Saint Louis accountant handle your payroll services.

How to Reduce The Risk of An IRS Audit

Getting audited by the IRS can be an overwhelming and inconvenient experience. There are certain red flags the IRS looks for when deciding which taxpayers to audit. Below we list a few ways to reduce the risk of getting audited by the IRS.

5 Common Quickbooks Mistakes

Quickbooks is the most common used and best accounting software on the market. Quickbooks makes accounting easier for both small and medium sized businesses when used correctly. Below we outline a few common Quickbooks mistakes which hurt your productivity and can make your business accounting inaccurate.

What Happens If You Don’t Pay Your Taxes

Failing to pay your taxes can lead to serious consequences. The IRS is one of the most aggressive debt collectors out there, so it is important to pay your taxes as soon as possible, even if that means setting up a payment plan and paying your tax debt over time.

3 Unexpected Business Expenses You Shoul...

Most business owners plan for regular expenses such as payroll, supplies, rent, and other regular expenses, but sometimes unexpected expenses may come up which may hurt your cash flow if you are not prepared.